14 Factors to Consider When Choosing the Best Place to Retire

Choosing a place to retire is one of the most important decisions you will make in your life. You’re not alone in looking for the perfect retirement location for yourself or your loved ones- many people are, as well. When you search “best places to retire” on the internet, you will see list after list of places all over the world. It can be overwhelming to choose from so many options!

Keep in mind that what may be perfect for one family might not be ideal for yours. There are many factors that you must think about and research. There’s no right or wrong answer when it comes to choosing the right place.

To avoid spending your golden years stressed out or unfulfilled, we’ve created this article to guide you through the process and help you make the best decision for this important stage in your life.

Statistics About Canada’s Older Adult Population

According to Statistics Canada, the number of Canadians 65 and over increased by 18.3% from 2016 to 2021, reaching seven million. This increase is the second-largest in 75 years, after the increase from 2011 to 2016, which was a rise of more than 20%.

Seven million Canadians aged 65 and over make up 19% of the population, an increase from 16.9% at the time of the most recent census.

A closer study reveals that the number of Canadians aged 85 and older increased by about 12% since the last census, while the number of people over 100 increased by more than 15%.

The agency stated that the number of people 85 and older might triple over the next 30 years, rising from 861,000 to 2.7 million.

According to demographic forecasts made by Statistics Canada, there may be about 12 million people in this age group by 2051, or close to one-quarter of the population.

Living Arrangements of Older Adults

The proportion of seniors in Canada is growing faster than ever thanks to rising life expectancy and falling fertility rates. In 2011, as the first baby boomers reached 65 years old, this trend started to pick up speed. In Canada, seniors now make up nearly 6 million people (1 in 6), surpassing youngsters aged 0 to 14 for the first time. Additionally, based on present patterns, it appears that this age group will keep expanding, with the percentage of seniors expected to increase to 1 in 5 by 2024 and 1 in 4 by 2055.

During the early senior years, the majority of those 65 and older live in a private residence as a couple- with their spouse or common-law partner. As older adults age, fewer people belonging to this age group live in private households, and women, in particular, tend to move to group residences.

Using data from the 2018 Canadian Community Health Survey, the Government of Canada discovered the following:

- 49.2% of seniors lived with a partner overall.

- Living alone may be harmful to healthy aging, according to other studies; nonetheless, the prevalence of living alone may be increasing among people in this age group.

- Other researchers found that, among people 65 and older, 31.5% of females and 16.0% of males lived alone in an analysis of the 2011 census.

- These percentages rose to 33.0% and 17.4% in the 2016 census.

- They reached 35.7% and 19.1% in their 2018 analysis of the CCHS.

- The elderly who were most likely to live alone were female, older, lower income, divorced or separated, residing in a densely populated area, renting, and having less education.

- Other studies have shown comparable outcomes. Female seniors have consistently been found to have a higher likelihood of living alone, both in Canada and in other nations, in part due to their longer life expectancy when compared to opposite-sex partners.

- Alternative research has found that seniors with little income or low education are more likely to live alone, which may be due to their inability to pay the high cost of assisted living facilities.

- The disparity in support and services available to seniors in rural areas may also be a factor in why seniors in urban areas were more likely to live alone. Urban areas have more services available so older adults can live more independently.

- The most popular services for seniors are senior centers, homemaker services, and transportation services, all of which are more likely to be available in urban areas.

Factors to Consider When Choosing the Best Place to Retire

The freedom to select where you wish to live is one of retirement’s main benefits.

There is no reason why you shouldn’t move to a location that appeals to you more once your employment no longer keeps you in a specific area. Perhaps you wish to go somewhere warmer, nearer the lake, or with reduced living expenses.

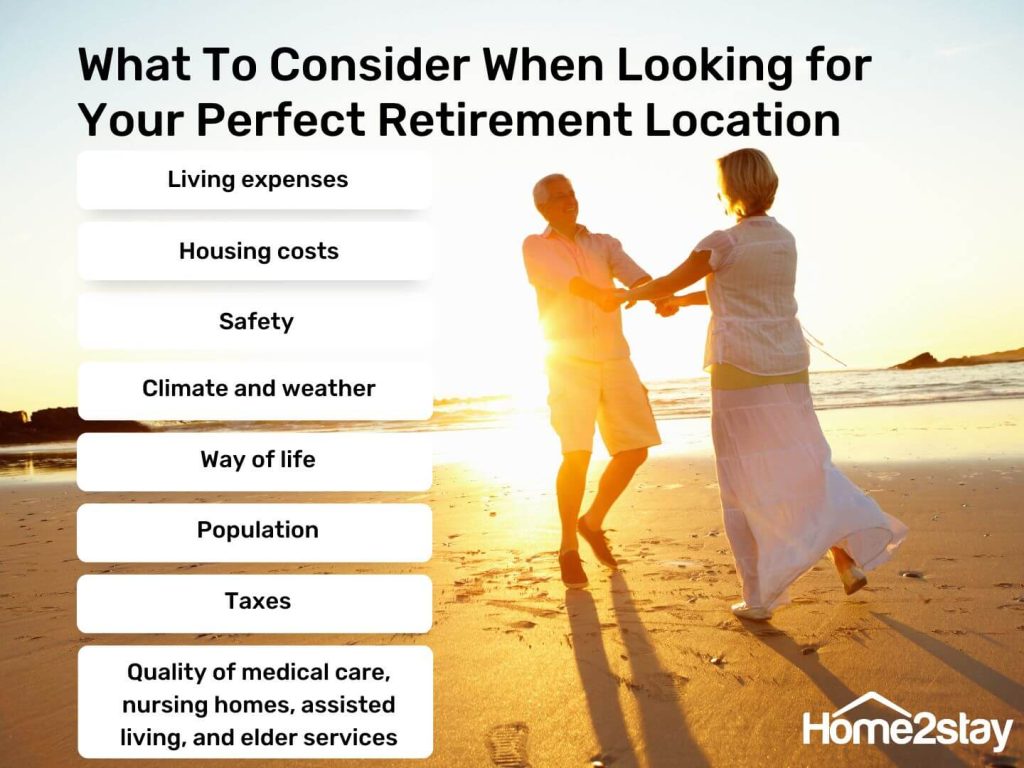

The cost of living, taxes, safety, and climate are just a few of the obvious factors you’ll consider while deciding where to spend your golden years. However, there are a lot of other important factors to take into account that might not be as obvious.

Choosing the ideal location for you can quickly become daunting with so many things to take into account.

To fully enjoy your retirement, you should consider the following 14 crucial factors when considering suitable retirement locations.

1) Living expenses

The cost of living is the first thing you need to think about, even if you have a lot of money. Living in a pricey area will drain your funds faster and make your later years more difficult.

When analyzing your living costs and retirement funds, take into account your projected living situation, such as the price of accommodation (rent or own a home), food, transportation, health care, services, and the price of engaging in the activities you enjoy (hobbies, travel, fishing, etc.).

If you intend to live in a condo or an active senior community, you need to learn about the monthly costs.

2) Housing costs

Housing costs will have the biggest influence on your retirement savings.

Price appreciation trends are another crucial factor to take into account if you are considering your house as an asset. If you are planning to rent a place, high housing costs could also have an impact on rent costs.

3) Safety

As you age and feel more vulnerable, safety issues may take on greater importance. Examine the economic information and crime statistics for the areas you are considering. Remember that a city’s many neighborhoods can have drastically varying crime rates.

4) Climate and weather

Living in a humid city might not be ideal if you have certain chronic diseases, particularly respiratory problems. The same is true when moving to an area with extreme cold, mainly if you are accustomed to milder climates. On the other hand, the heat of a sunny place might prove too much for you.

After retirement, a lot of people decide to relocate to a warmer environment. Even while there are lovely cities in colder regions that provide wonderful services for retirees, the reality is that winter weather conditions get more difficult as you get older. It will become more physically taxing to shovel snow, and there is a higher risk of injury if you stumble on an icy surface.

So, before making a decision, consider the weather carefully. Before opting to relocate there, it is ideal to visit the city in question in different weather conditions.

5) Way of life

This depends mainly on your personal preference. The quiet, tranquil, and “slow” existence of small towns may appear pleasant at first, but if you’ve spent your entire life in a busy city, it may get monotonous after a while. Consider your primary retirement employment and activities as well.

If your hobbies are mostly home activities and you are more of a homebody, most cities may appear the same to you. However, if you are active, and enjoy traveling, hiking, or other outdoor pastimes, you should choose a retirement location where you can still do these activities. If you are used to visiting specific stores to do your shopping, you could miss them if they are not accessible in your new area. Ask yourself if you could be satisfied in a place where these stores aren’t available, for instance, if you are accustomed to having a Costco or a Safeway nearby.

The same applies to places like farmers’ markets, your favorite kinds of restaurants, arthouse movie theaters, churches of your denomination, and so forth.

Sometimes the smallest, most insignificant things can have a significant impact.

6) Population

Some prefer the solitude of a large metropolis where you can live for years without ever meeting your neighbors. Additionally, larger cities offer more options because they have a wider range of businesses and facilities.

Others enjoy chit-chatting with their neighbors over the fence and the sense of camaraderie that comes with living in a small, tight-knit community. They favor the peace that comes with a smaller population. Selecting the location where you will retire will depend on which of these you are.

7) Taxes

Keep in mind that you will rely heavily on your savings once you retire. So consider costs like property taxes, which you’ll have to pay even if you can buy a home in the city where you plan to retire. The property tax rates alone can result in a difference of tens of thousands of dollars over time.

Make sure to take the big picture into account while evaluating the tax burden of a location you are thinking about moving to. While some provinces may not have a sales tax or an income tax, other taxes in those provinces can be greater. After all, provinces must recoup their costs somehow. How a province or city’s tax system affects you will depend on your income sources and spending habits.

8) Quality of medical care, nursing homes, assisted living, and elder services

You’ll probably have minimal need for medical services outside of routine doctor visits during the early years of retirement while you’re still healthy and active.

As you age, however, finding decent, reasonably priced assisted living facilities and nursing homes, as well as good doctors and hospitals, becomes increasingly important, especially if you have ongoing medical problems. Moving to a new location to access better healthcare will become more difficult. The region you are considering should have healthcare services that you can take advantage of.

An indicator of how easy you’ll have access to medical treatment if you need it is the concentration of doctors per capita.

The COVID-19 pandemic served as an important reminder of the value of assessing not just the accessibility and caliber of medical services, but also the skill with which municipal and state governments handled the crisis.

It’s important to be aware of the kind of senior activity centers, clubs, organizations, home care providers, and transportation for those with mobility issues that are offered in the community you are considering, just as it is with doctors, hospitals, and retirement homes.

The availability of high-quality medical care today is a strong indication of what should be offered in the future, even though many things may change.

Additionally, it would be a good idea to find out if the retirement locations you are looking into have local accessibility aid providers. Keep in mind that if you wish to live independently, you will need to make your accommodations suitable for aging in place. Having a local provider (or one nearby) will make acquiring and installing such devices less costly and more convenient, compared to having to import from distant locations.

9) Amenities and facilities to support your desired lifestyle

Find out whether each location you are considering has the amenities that will support your interests after evaluating the activities you intend to engage in during your retirement.

If you like doing arts and crafts, for instance, check to see if there are art supply shops, galleries, or locations that provide painting workshops. Find out whether there are bands or orchestras you can join and possibilities to perform if you intend to play a musical instrument. Look into what the neighborhood restaurant scene has to offer if you like gourmet dining or international cuisine.

The same holds for adult education programs, galleries, theaters, live performances, outdoor recreation areas, golf courses, and more.

10) Proximity to a local or international airport

If you want to travel during retirement, you’ll find it more convenient to live close to an airport with regular flights to a variety of locations.

It will be more tiresome if you have to drive several hours to get to the airport, aside from the time you have to spend on a flight. Hailing a cab or using a ride-hailing app to get to the airport can be quite expensive and it can be difficult to arrange to have friends drive you to the airport.

Living near an airport will make commuting simpler for your out-of-town relatives and family.

11) Indicators of future growth or decline

Even though the town or neighborhood you are contemplating may appear attractive right now, try to think about how it will hold up over time.

Over time, a lot may change, but there are a few indicators you may look for. A city’s future is bright if the local economy is robust and the major employers are in fields with a promising future, including technology and medical research. A high concentration of outdated manufacturing facilities, however, holds little promise.

University towns and provincial capitals are more likely to experience long-term stability.

You can look at trends in employment rates and population growth online. When you do an ocular, you can look around if there is a lot of new construction and neighborhood redevelopment, or if homes are falling into ruin and retail areas have a ton of abandoned storefronts.

12) Opportunities for social interaction

One of the key elements of a good retirement is a vibrant social life.

You could plan to move to an active adult community or reside in a place with a higher senior population if you prefer to socialize with other retirees.

If you want to meet people who share your interests but are of different ages, you can check out groups thru social media and read local publications to get a sense of the available social interaction opportunities.

13) Diversity

Canada has always been known for its diverse population. Canadians have undoubtedly learned to value engaging with a wide range of people and delving into a wide array of cuisines and witnessing different cultural practices. You should think about if you would feel more at home living in a neighborhood where everyone is similar to you or whether you want to be surrounded by people of different ages and demographics. Then you can assess whether the communities you are considering offer what you’re looking for.

14) Political environment

Regardless of where your political beliefs sit on the spectrum, you should think about whether you would feel at home in a setting where the vast majority of individuals have a different political stance. Especially during presidential election years, politics is certain to pop up in casual talks.

You should also think about the likelihood that municipal and state governments will pass laws that you support.

Conclusion

When it comes to retirement, the best place in the world is the one where you can be most happy. Getting to that happy place, however, can be a little trickier than you might think. The best method to choose the ideal retirement place for you is to aim for the best possible balance between your retirement objectives, financial situation, access to the amenities you’ll need as you age, and quality of life.

While some of these factors are subject to personal preference, others are not. You must conduct thorough research to find the best places to spend your golden years.

We hope that these tips help you to create a better plan for your retirement. We can’t relay the importance of thinking about what you want in a retirement community before moving there: once you live in a place, it can be very difficult (and sometimes impossible) to relocate later down the line. So take your time and do some research before making a final decision. You’ll thank yourself years from now!

You can’t call a place home unless you can enjoy freedom, safety, and independence there. Let Home2stay prepare your living space for retirement if you have chosen to live in Vancouver or Lower Mainland. Our accessibility solutions include stair lifts, grab bars, handrails, barrier-free bathrooms, elevators, etc. to help you stay safe and independent in your home.

Leave a Comment

We'd Love to Hear Your Thoughts Got something to say? We're all ears! Leave your comments below and let us know what you think. Your feedback helps us improve and serve you better. Can't wait to hear from you!