Retirement Checklist : 16 Things You Need to Consider Before You Retire

Retirement is an exciting time marked by the beginning of a new chapter in one’s life. It is a long-awaited dream for many people. But what do you need to keep in mind when preparing for retirement?

This post will go over the critical factors you will have to look into before embarking on this new phase of life.

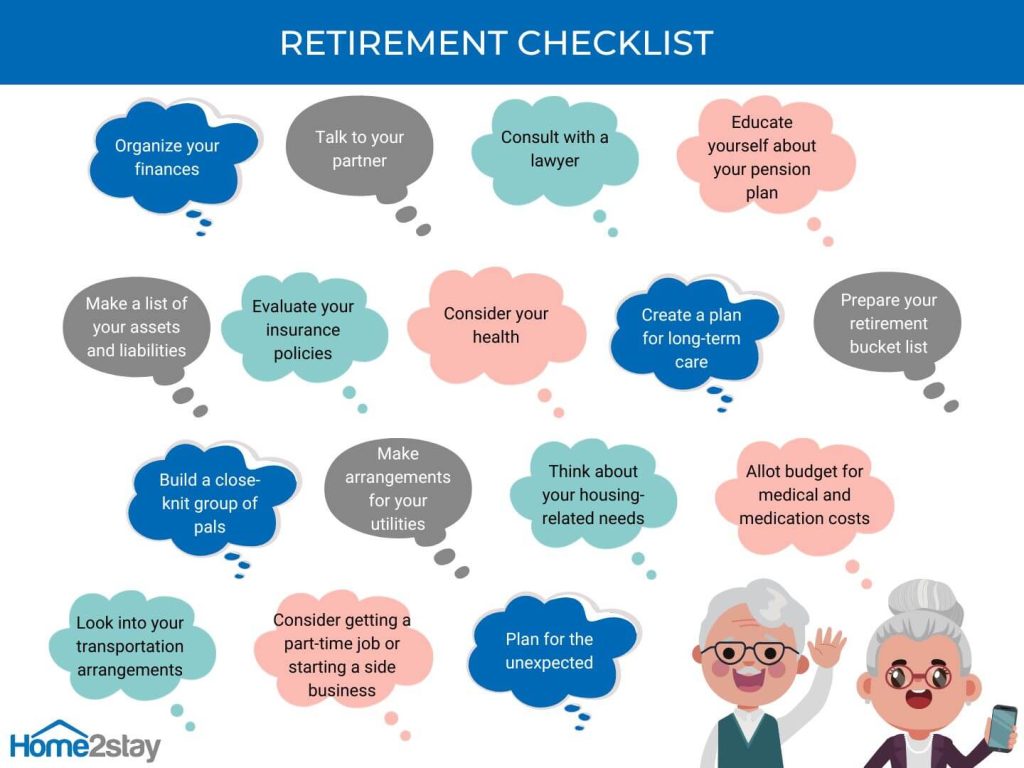

Retirement Checklist

1. Organize your finances

Most people’s primary concern as they near the end of their working life is whether they will have enough money to retire. After all, retirement could last for 20, 30 years, or even longer. Therefore, it’s imperative to make sure you have enough financial resources to cover your expenses.

How much money would you need to live comfortably in retirement? There isn’t just one correct response to this question because everyone has various demands and goals. It depends on your financial situation and how long you will live.

The generally accepted rule is a person needs between 70 and 80 percent of his or her preretirement income to fulfill post-employment expenses. For example, “If I earn $55,000 per year, how much money do I need to retire at 65?” You would need to have an annual income of $38,500 to $44,000 based on the 70-to-80-percent ratio.

Accordingly, you would require assets totaling between $770,000 and $880,000 to support a 20-year retirement. And you would need anywhere between $1.16 million and $1.32 million if you retired early or live up to 30 more years after retirement.

The amount you require will vary depending on your specific circumstances. If you are currently spending 90% of your income on basics like rent and food, you will likely need to replace more than 80% of your working income to maintain your level of living. However, if you’ve been spending 30% of your income to paying down your mortgage and you finish paying down the remaining sum before you retire, you may be able to live comfortably on less than 70% of your pre-retirement earnings.

Don’t forget that not all of your money needs to come from your assets and savings. Your retirement income may also be influenced by your ability to receive Social Security benefits, rental income, or pension payments.

Here are some additional tips on how to make sure you have enough to live on in your retirement years:

- Start putting retirement funds aside as soon as possible.

- Pay off your debt.

- Spend less.

- Set your retirement budget

To be financially prepared for retirement in your 60s, it is generally advised that you save 10 to 15 percent of your earnings. However,

if you can manage to save 20% or more of your income starting at age 20, you may be in a position to retire comfortably at age 50.

Debt payments reduce your cash flow and your ability to invest and save money. Before retiring, you should pay off any high-interest debt, such as credit card debt and auto loans. Some people opt to use cash instead of credit cards because that way, they can’t spend money that they don’t have.

Another wise decision is to pay off your mortgage. For many retirees, paying off their homes before they stop working feels liberating. However, investing more funds in retirement accounts that hold stocks or bonds may be more advantageous when interest rates are low.

Reducing your spending has two key benefits: first, it frees up more cash for retirement savings, and second, it prepares you for a lower-cost lifestyle that you might want to lead once you retire.

Consider moving to a region with a cheaper cost of living or downsizing to a smaller property as housing will be one of your main retirement expenses. You might also want to consider moving to a location with no personal income tax – just be mindful of other tax implications, like property tax rates.

Spend less on unused gym memberships, cleaning services, cable bills, banking fees, restaurant meals, and other expenses. Reduce the number of vehicles you own from two to one, or go somewhere with reliable public transportation so you can live without a car.

When feasible, take advantage of elder discounts. If you want to retire comfortably, you must live within your means.

To make sure you don’t waste your limited income, you must establish a budget before you retire. Make a spreadsheet with all of your estimated living expenses for retirement, such as those for groceries, housing, healthcare, and taxes. List the expenses and specify which are constant (occurring each month at the same amount) and which are adjustable (i.e., occur every month or randomly with different amounts).

Having this knowledge makes it easier to ensure that you know how much you need for your living expenses and you can plan accordingly.

Working with a financial counselor is a great way to make wise financial decisions before you retire. Advisors can offer investment advice, assist you in choosing the best retirement account, and develop a sound budget for you.

If you want even more guidance, a retirement planner can help you integrate your assets and income sources into a monthly payment scheme during retirement.

2. Talk to your partner

If you have a spouse or a partner, sit down and talk about your shared retirement objectives. Can you both retire at once? Do you both hope to retire early? Will one of you stay employed while the other begins to retire?

A plan and a strategy for how to spend your retirement years together can be successfully implemented if you and your partner are on the same page.

3. Consult your lawyer

Your way of life will probably change considerably once you retire. You should thus reassess your end-of-life planning. A power of attorney, a will, and medical directives should all be in place.

You may also have different estate plans as a retired person than you did when you were employed, so speak with your lawyer to make arrangements for any changes to your will when you retire. It’s crucial to make sure that your will is legally binding to ensure that your loved ones are taken care of in the event of your passing. Spend some time updating the asset distribution among your beneficiaries, if necessary.

If you are a business owner, reviewing your will and trust paperwork is crucial if you plan on retiring. If you pass away or become incapacitated, there can be unique issues that need to be resolved.

4. Educate yourself about your pension plan

The Canada Pension Plan (CPP) is a government-sponsored mandatory old-age pension system that is publicly funded. It offers benefits for survivors, disabled people, and retirees. It is one of three levels of the Canadian retirement income system. Almost everyone who works in Canada is qualified to contribute to and benefit from the Canada Pension Plan.

Your CPP retirement benefit is determined by the amount and length of time of your CPP or combined CPP and QPP (Quebec Pension Plan) contributions. The amount you receive is also influenced by the age at which you decide to retire. The CPP retirement benefit is adjusted following inflation each year.

You can apply for and receive your full CPP retirement pension at age 65, as early as age 60 for a reduced amount, or as late as age 70 for an increased amount.

5. Make a list of your assets and liabilities

Are you aware of your net worth? Make a list of all your assets as you get ready for retirement, including cash, real estate, cars, personal property, bonds, stocks, and investments. You can plan better for your retirement income sources by keeping track of your assets.

Don’t stop there, though! Make another list of all obligations, including credit card debt, mortgages, vehicle loans, student loans, and other loans. As mentioned above, one of the most crucial things you should do before retiring is pay off your debt since if you don’t have to make monthly payments toward your debt, your retirement savings and income will last much longer.

6. Evaluate your insurance policies

A large number of companies provide life insurance in their employee benefits package. You might lose this coverage, though, when you retire. Having life insurance in the retirement phase of your life can help your beneficiaries cover large bills like mortgage or funeral costs after your passing.

While checking, renewing, or replacing a life insurance policy does not necessarily need to be one of the initial steps in retirement planning, doing so will make the years that follow more carefree and comfortable. Make sure that any unpaid bills will be covered in the years following your retirement by taking the time to evaluate your life insurance policy.

When you retire, make sure you also have health and disability insurance in place so you are covered in case you get sick or have an accident. If your health declines during your retirement years, this could force you to move out of your house if you do not have the necessary coverage for your health needs.

7. Consider your health

Before you bid goodbye to your working life, utilize your employer-sponsored health insurance. Ensure that all of your annual exams, medicines, hearing aids, dental treatment, and eye care are current. Visit your doctor annually after retiring (or as covered by your retirement health insurance plan).

Be sure to contact your doctor for advice on post-retirement health, fitness, and nutrition because maintaining your physical health in retirement is essential to a decent quality of life and can help keep healthcare costs low.

8. Create a plan for long-term care

You never know for sure if you will need long-term care or not. Therefore, it is best to have a plan in place for how you and your family will handle long-term care if that becomes necessary. You might want to consider getting insurance and deciding what kind of institution you would prefer to be in should the need for long-term care arise.

9. Prepare your retirement bucket list

- Find an enjoyable hobby

- Map out your travel plans

- Learn a new skill

Discovering a hobby you enjoy is among the most significant items to cross off your retirement

bucket list. In retirement, your mental health will be equally as important as it is today, if not more

so.

A lot of people work 40 or more hours per week, and when they finally retire, they often don’t know what to do. After retiring, some people experience a lack of purpose. Having a pastime that you enjoy doing can help you combat this restlessness.

Having the freedom to travel is one of the best aspects of retirement. Plan to get the most out of your travel budget! Extended-stay hotels are a terrific choice for affordable housing and stretching your travel budget.

Additionally, you can book longer holidays through VRBO or Airbnb, which are frequently more flexible and cost-effective than conventional hotels. Include vacation preparation on your retirement bucket list, regardless of whether you want to travel locally or internationally.

What is something you always wanted to learn but never had time to do so? Retirement offers you the perfect opportunity to learn a skill you have always wanted to learn!

Make a list of skills you are interested to learn and add them to your bucket list.

10. Build a close-knit group of pals

While having interests is crucial, it is also wise to be in the company of like-minded individuals. Make sure you have pals you enjoy spending time with because you’ll have more free time in retirement.

In retirement, a lot of people opt to relocate near their friends or family. There are many retirement communities across the nation that are designed for individuals to live near one another. Many of these communities have recreation centers with staff on hand to organize events for locals.

Even if you don’t relocate to a retirement community, be sure to surround yourself with people you like.

11. Make arrangements for your utilities

Your utility bills should remain as consistent as possible. The majority of utility companies let you set up a fixed monthly payment set-up that stays the same from month to month and averages out your usage for the entire year. This keeps your payments predictable and makes budgeting for them simpler.

12. Think about your housing-related needs

Don’t overlook housing when getting ready for retirement. There are a few things to think about while deciding whether or not your existing home will be acceptable for your later years.

- Are you going to rent or own your home? How much is the rent? If you own your home, has your mortgage been paid off? What about utilities? Keep in mind that all these factors will affect your retirement financial situation.

- Will it be easy and safe for you to move around your house as you get older?

- Location

You must prepare your home for aging-in-place. Whether you will continue living in your current home or plan to move to a new place, your home must be equipped with the right tools and equipment to make it more accessible as you age.

Do you have adequate accessibility aids like grab bars, handrails, and safety poles to aid you as you move around your home, especially in the kitchen and bathroom area?

If you live in a multi-story home, think about how you will navigate the stairs safely once your mobility declines. Consider installing a stairlift, vertical porch lift, or elevator in your home to help address these issues that might arise soon.

Do you intend to stay where you are or relocate to a new city or country? Do you want to move closer to your loved ones?

Lenders are more likely to approve loans for borrowers with income, so if you’re thinking of downsizing to a condo or moving to a new location, you might want to make the change before you leave your job.

13. Allot budget for medical and medication costs

If you are in the age range when medical care is more likely to be needed, you should budget for medical expenses and prescription costs. You should be ready for higher out-of-pocket healthcare expenses in retirement.

14. Look into your transportation arrangements

If you cannot drive or are thinking of lessening your driving once you retire, look into senior transportation options and set aside funds to pay for such costs. There are lots of travel options you can consider, such as buses, ride-hailing apps, carpooling setups, taxis, etc.

15. Consider getting a part-time job or starting a side business

Some retirees discover they require additional income after a few years to cover their living expenses. Others discover that they miss the regularity and interactions that come with working.

Working a part-time job is a great way to maintain financial security and social engagement. For retirees looking for fulfilling employment with flexible hours, common part-time job alternatives include substitute teaching, retail jobs, administrative support, and child care.

You can apply for a seasonal job or something that you can do for a few hours a day.

Want to turn your passion into money? You might want to build a business that you can operate after retiring so that you can continue to actively pursue the things you are passionate about while also earning some extra cash.

16. Plan for the unexpected

While maintaining a strong retirement account is crucial, don’t overlook creating an emergency fund! You should keep at least six months’ worth of living expenses in this savings account, which can pay for rent, insurance, and other expenses, in case of an emergency or delays in your pension.

An emergency fund is also essential if you would like to opt for early retirement.

Conclusion

The idea of retirement looks enticing to many but it is important to prepare properly for it so that you can enjoy your life to its fullest.

It’s never too soon to think about being prepared for retirement. Even if you are just thinking about it for the first time, or if you have been doing so for some time now, do not let retirement be an abstract concept. Let this checklist be your guide and use it as a tool to advance your work towards the day that you decide to stop working and start enjoying the fruits of your labor for the rest of your life.

Making decisions about your home accessibility and safety as you advance into old age doesn’t need to be complicated. We at Home2stay can help you identify the most important solutions for you, and ensure that you’re on track with them. Let us help you on the road to a happy and successful retirement. Set up a FREE ASSESSMENT with us!

Leave a Comment

We'd Love to Hear Your Thoughts Got something to say? We're all ears! Leave your comments below and let us know what you think. Your feedback helps us improve and serve you better. Can't wait to hear from you!